Your Advantages with label.co.uk

- no additional fees

- fast and simple customs clearance

- professional customer service

- free delivery in EU and UK

- we take care of customs duties

Easy Customs Clearance with label.co.uk

Since 01.01.2021 businesses in the EU making trade with companies located in the UK must adhere to several rules for exporting goods. The same goes for businesses importing goods into the UK. Label.co.uk have taken measures to export labels more quickly and easily in the future.

After going through numerous steps of certification our online printing company was successfully registered as an approved exporter. This means we are registered for simplified customs declaration. As an approved exporter we can now dispense with the actual clearance at the customs office of export before the goods are shipped. We declare the goods electronically and the export accompanying document is sent to us. So, our labels are automatically released and directly handed over for export. The approval process, which before took about two days, is now a thing of the past.

Overview – What is VAT Applied to

VAT is charged on things such as:

- goods and services (a service is anything other than supplying goods)

- selling business assets

- commission

- business goods used for personal reasons

- ‘non-sales’ like bartering, part-exchange and gifts

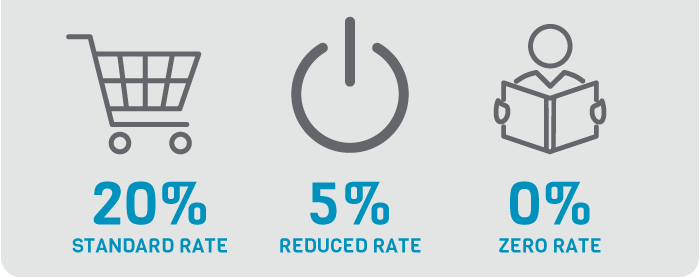

Current VAT Rates

VAT and Duties

VAT or Value Added Tax is a consumption tax. Its standard rate lies at 20% and is applied to most goods bought or sold in, as well as imported to, or exported from the UK. Still, there are certain exceptions. The VAT rate for domestic fuel such as gas or electricity for example is only at 5%. Books or newspapers, brochures, and public transport are not affected by VAT at all. The VAT rate applied to labels imported into the UK is at 20% because they fall under the standard category.

Customs Duties apply to goods worth more than £135 as well as excise goods – e.g. tobacco, alcoholic drinks, energy products – imported into the UK. On these goods you will have to pay both VAT and Customs Duties. However, that is not the case for ordering labels with label.co.uk. We take care of the Customs Duties, so you don’t have to worry about additional costs.

VAT – What to Pay Attention to

Not all businesses are registered for VAT. The HMRC (Her Majesty’s Revenue and Customs) annually sets a threshold for businesses’ turnovers above which registration is mandatory. Corporations who find their turnaround does not exceed this threshold, can register voluntarily, though. Without an official registration you cannot send a VAT-return to HMRC. On their VAT-return, registered businesses can claim the Value Added Tax as input tax. A VAT-return hence makes it possible to attain a refund on the VAT you paid for imported goods. It is best to keep detailed records of your imported purchases (contracts, invoices etc.) to assure claiming back your Value Added Tax without complications. You can learn more about VAT returns on the official government website. Also, when buying services from suppliers outside the UK, registered businesses can apply what HMRC call the reverse charge VAT. This means that the recipient of the goods or services declares their purchases (input VAT) and the supplier’s sale (output VAT) in their return. The two entries then cancel each other out.

Tools and Services

In order to review and test our materials & print quality most comprehensively, we recommend requesting a complimentary sample book or viewing the list of our standard labels online.

If you have questions regarding personalisation or any other topic related to label printing, we would be happy to advise you. You can call our customer service from Monday to Friday between 9.00 a.m. and 5.00 p.m. at 0044(0) 2035881080 or write an email at info@label.co.uk.